The Importance of Compound Interest

The computer. The iPhone. The internet. All of these are revolutionary inventions, but none of these inventions comes close to what Albert Einstein considered man’s greatest invention, compound interest.

As an investor your successes depends on a firm understanding of compound interest. As someone that borrows money, whether in the form of a loan or credit card, knowing about compound interest can help you to save money. Compound interest is not the same as simple interest. To understand compound interest allow me to first explain simple interest.

Say you have $1,000 at a simple interest rate of 10% annually. Every year thanks to interest rates you will make $100 in other words 10% of $1,000. Over a five-year period with simple interest you would have received $500. If this sounds good to you then what’s coming next is going to knock you out your seat. With compound interest if you start with $1000 at 10% annually, the first year you will have made $100. But over a five-year period, you would have made roughly $611. Over $111 more than what simple interest would have given you!

Though that may not sound like a lot now consider what it would be 30 years down the line. With simple interest your investment would be $4,000 whereas with compound interest your investment of $1,000 would have turned into 17,449. A whole $13,449 more! This is the power of compound interest.

How Does Compound Interest Work?

Simple interest takes your principal amount (your original deposit of $1000) and accumulates interest off of it every year. While with compound interest your principal amount changes as you gain money from interest. As your account grows in value interest is taken off what it becomes instead of what it was.

So, if you start with $1,000 with an interest rate of 10% the first year you make $100. The second year you gain 10% interest off of $1,100 which is $110. Essentially combining the new amount with the old, every time your money compounds. This is the power of compound interest.

Here is a visual representation of how $1,000 compounds at 10% every year:

| Years | Amount Invested | Earned Interest | Total Earned |

|---|---|---|---|

| 1 | $1,000 | $100 | $1,100 |

| 2 | $1,100 | $110 | $1,210 |

| 3 | $1,210 | $121 | $1,331 |

| 4 | $1,331 | $133 | $1,464 |

| 5 | $1,464 | $146 | $1,610 |

Double You Money

The easiest method of calculating how compound interest effects your money, is with the rule of 72. This rule only applies to annual interest rates, used to determine how long it will take to double an investment. The rule of 72 works by dividing the rate of return by 72. Using the numbers from the example above, to figure out how long it would take to double that $1000 plug in the numbers: 72 10 = 7.2. So, at a 10% interest rate it would take about 7.2 years to double the initial investment.

Remember that this works only on interest rates that compound on a yearly basis. However, compounding can occur at different time periods operating daily, monthly, quarterly, semi-annually, & annually. The more compound periods that occur the faster the initial amount grows.

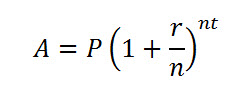

To find out how much an amount would grow at different compounding periods there is another formula:

Now I could take the time to explain how to solve but let’s be real this isn’t algebra class. You have more important matters to attend to than learning to solve a math problem. In the real world we’re allowed to use calculators without it consider cheating, so I advise to do just that. Search the web for compound interest calculators and plug the numbers in.

Final Thoughts

Compound interest rates allows money to grow at a predictable rate. It doesn’t matter if you have $1,000 to invest or $100,000. Anyone can get started & the sooner the better.

If you can only afford to invest $1,000 a year your money will have gained in value tremendously over time. That’s roughly $83 dollars a month. Now that you have a basic understanding of this principle use it to guide your decision making.

Compound interest applies to loans and investments. Knowing how much money will grow in a certain time period allows you to make better spending decision. The person who understands it earns it those who don’t pay it. Use this knowledge to your advantage. Determine your investment goals and plan accordingly. View all your loans and plan to pay it off asap, it will save you money in the long run.

About the Author

Charles Findlay is a finance writer. Four years ago he discovered his love for the world of finance. Now he has decided to share his love of this world through writing. Charles is currently learning more about this topic at Montclair State University. Within a few years he will have his degree and hopefully will have taught many about finance through his writing.